In New Zealand almost all off-road machines, such as excavators, loaders and graders, are fuelled by diesel. This amounts to around a billion litres of diesel each year – almost 30% of all diesel use nationwide.*

But with recent advances in electric off-road technology, electric machines are likely to become a common feature of job sites.

Here, we dig into the benefits and challenges of electric off-road vehicles, and what the market looks like for New Zealand businesses.

Digging in to the future with electric machines

With the promise of lower running costs, zero emissions, and quiet operation, it’s clear to see why demand exists for electrified heavy machinery.

Many sites around the country have started to trial and embed the use of electric equipment, overcoming perceived challenges around charging and duty cycles.

High capital costs remain a barrier, but battery prices are expected to come down in the years ahead, making electric machines a sound investment for more New Zealand businesses.

Market research

EECA and MartinJenkins undertook research to understand the opportunities and challenges for electric construction equipment.

The research scope included:

- a review of international technology scans

- interviews with New Zealand market participants

- an assessment of total ownership costs of electric off-road machines compared to diesel equivalents.

This webpage highlights key insights from the report.

Benefits and challenges to electric off-road equipment

Benefits

- Decreased operating costs – Due to the significantly higher efficiency of electric motors over diesel, electric machines use much less energy, and are therefore cheaper to run. In addition, electric motors require less maintenance, so over the life of the machine it is expected to be notably cheaper than a diesel equivalent. Businesses with electric machines are reporting operating cost reductions of around 70-80% compared to diesel.

- Better operating performance – The high torque and fast response of electric motors allows for greater performance than diesel, improving both speed and precision. For many machines the extra weight of batteries can act as counterweights for stability when lifting heaving loads, rather than using cast iron or concrete.

- Clean and quiet – With lower noise and no exhaust emissions, electric machines provide a safer and more pleasant environment for workers. Internationally, some inner-city areas require contractors to use electric equipment to reduce the negative sound and air pollution that construction has on residents.

- Zero emissions – For companies operating heavy equipment, the diesel burned by their machines is often their largest source of emissions. As customers begin to consider emissions when contracting suppliers, electric machines give businesses a competitive edge.

Challenges

- High capital costs – Due to low production volumes, the capital cost of electric equipment can be 2-3 times more than a diesel equivalent. While operating costs are significantly lower, they may not entirely offset the higher upfront cost, depending on the vehicle and its expected lifetime. Some manufacturers are offering warranties twice the length of diesel equivalents to help offset this.

- Low duty cycles – Most machines are expected to be able to complete an 8-hour shift. While some do, many electric machines don’t yet have the battery capacity to reach this, instead sitting around the 5-hour mark. This may work for some lower utilisation sites, and charging in breaks can help, but for widespread adoption the 8-hour mark is needed.

- Access to charging in remote locations – Machinery can be needed in remote sites with poor grid connections, or be spread across multiple sites to be used when needed. This can make installing fixed chargers an expensive undertaking, or requiring emerging alternatives like battery trailers. Fast chargers are a mature technology due to the electric car market, but mobile options are limited. Battery swapping may be an option but will often require onsite infrastructure of its own to lift the heavy batteries.

- Small-market limitations – Because New Zealand is such a small market, it can be difficult to secure supply from international manufacturers. Other countries are able to place larger orders which gives them preference with manufacturers – leaving us with longer wait times.

The 3 most common off-road machines

Globally, the 3 most popular machines are loaders, excavators and mini excavators. According to industry experts IDTechEx these machines make up more than 75% of all construction vehicle sales. Unsurprisingly, these have been the highest priority for manufacturers looking to offer electrified options.

Total cost of ownership comparison

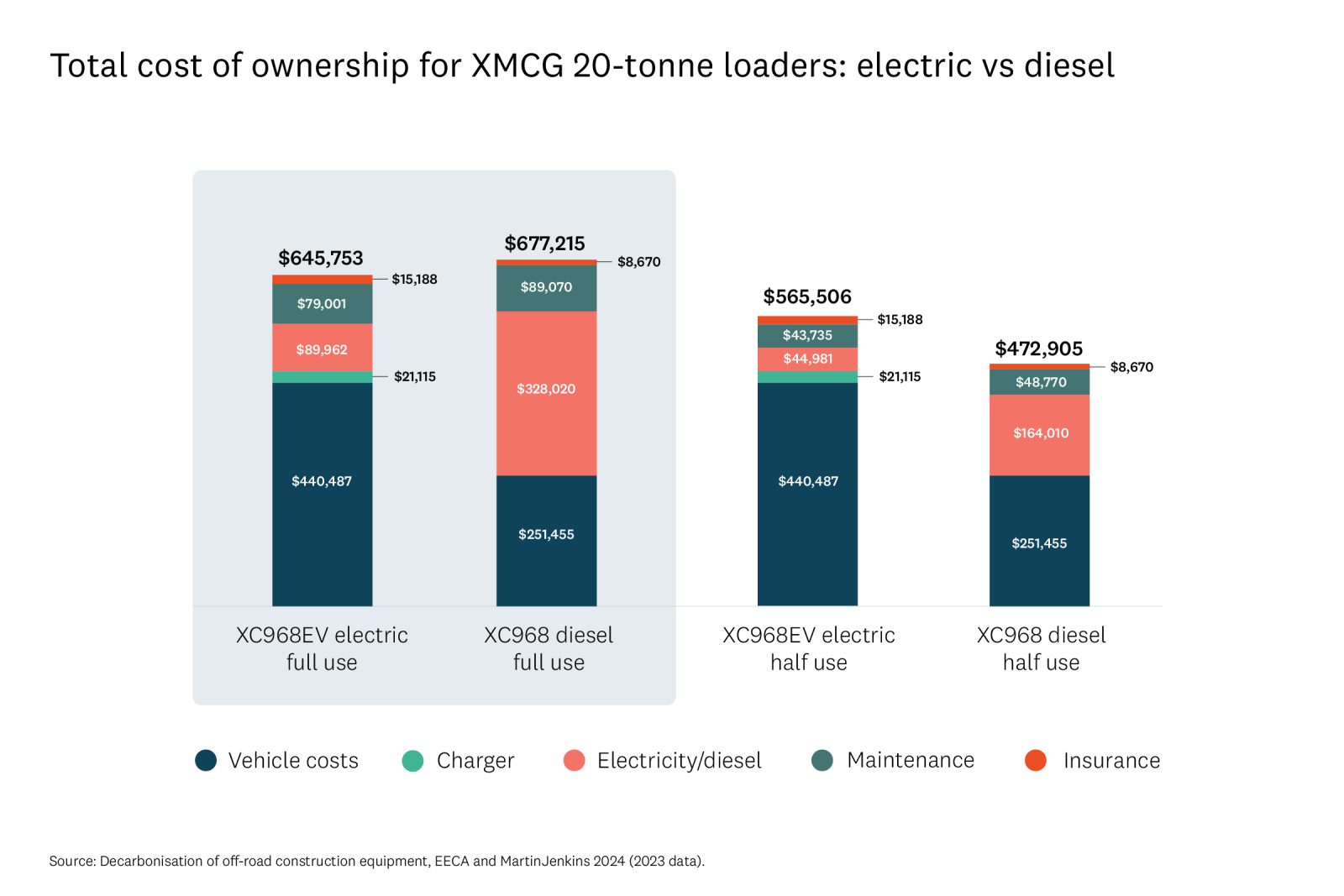

MartinJenkins undertook a total cost of ownership (TCO) analysis of an XCMG 20-tonne diesel loader and its battery electric equivalent based on an 8-hour duty cycle.

Despite the electric option coming with a $200,000 purchase premium, the significant energy savings achieved working eight hours a day resulted in a lower total cost of ownership over an 8-year lifespan.

These results show that businesses can maximise the financial benefit of electrification by targeting high-use machines first.

Case studies: Electric machines are proving popular in trials

4 minutes

Machine operators and business leaders at New Zealand companies Fulton Hogan, Reliance Transport and Leach & Co. talk about their experience using electric off-road vehicles.

Forecast for the future

IDTechEx estimates that current global sales of electric construction equipment sit at around 0.5% of the global market, and forecasts that this will increase to 43.5% by 2042. The market increase is expected to be driven primarily by excavators, mini-excavators and loaders.

Several of the current barriers to the uptake of electric off-road equipment in New Zealand will reduce or become easier to manage as time goes on.

As production of batteries for off-road use increases, and operators become more familiar with the technology, prices will decrease, while technology enhancements, such as battery capacity and charging options, will improve.

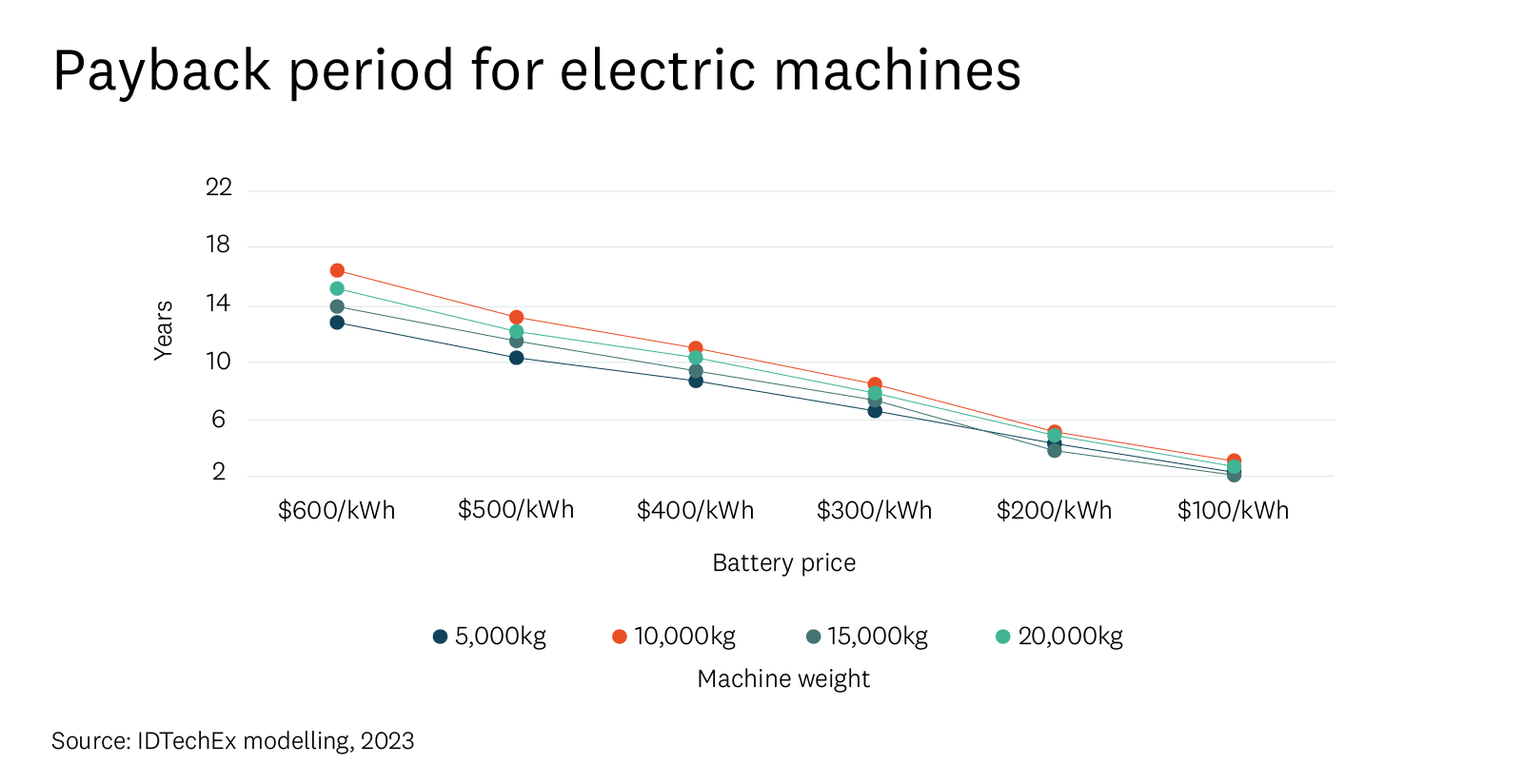

Battery prices are the major influence over electric equipment prices and are expected to rapidly decline.

As manufacturers are still producing in very small quantities, battery prices for off-road equipment are much higher than seen in other areas of the market. Batteries used in off-road equipment currently cost around US$600-700/kWh, compared to light vehicle battery prices of closer to US$100/kWh. IDTechEx modelling shows that if construction vehicles were to reach these prices, most applications would pay back after less than 3 years, strongly pushing the economics in favour of electrification.

Battery capacity is increasing quickly, leading to longer duty cycles.

Due to the cross-sector demand for high density lithium-ion batteries, improvements are being seen in more than just cost. The tough requirements for light vehicle batteries to have high capacity with a low weight and size will have flow on effects for the off-road equipment industry. With a greater amount of energy storage available in battery of the same footprint, duty cycles will naturally increase as a result.

Portable batteries will make electrification possible on temporary and remote job sites.

Manufacturers are also building portable batteries, which can be towed between jobsites. These can be slowly charged through the day in grid constrained areas, to then provide fast charging for vehicles in break times, or to allow multiple machines to charge simultaneously overnight. Currently sites are often serviced by trucks carrying a diesel tank, in future we may see them carrying batteries instead.

Explore support opportunities

We can help your business become more productive with less energy, and support your switch to renewable energy sources.

Read next

-

Electric loader outperforms diesel

Southern Landfill’s electric wheel loader is big on performance, low on noise and operating costs.

- Electric vehicles

- Decarbonisation

- Case study

-

Liquid biofuels insights summary

EECA commissioned Sapere to prepare an independent report to gain an overview of the role liquid biofuels could play in decarbonising New Zealand’s transport sector.

- Biofuel

- Decarbonisation

-

Off-road liquid fuel insights

Petrol and diesel power many vehicles and machines that will never be used on a road, so remain out of sight, out of mind. This research has given us a more detailed understanding about where emissions from this fuel use come from.

- Decarbonisation

- Fossil fuel